Surviving Old West Towns: What Remains of the Wild West Today

October 23 2025Blockchain Compliance

When working with blockchain compliance, the practice of making sure blockchain projects follow legal and regulatory rules. Also known as crypto compliance, it bridges the gap between innovative tech and government standards. If you’re new to the space, think of it as the safety net that keeps token issuers, exchanges, and developers from stepping into trouble.

Key Players and How They Fit Together

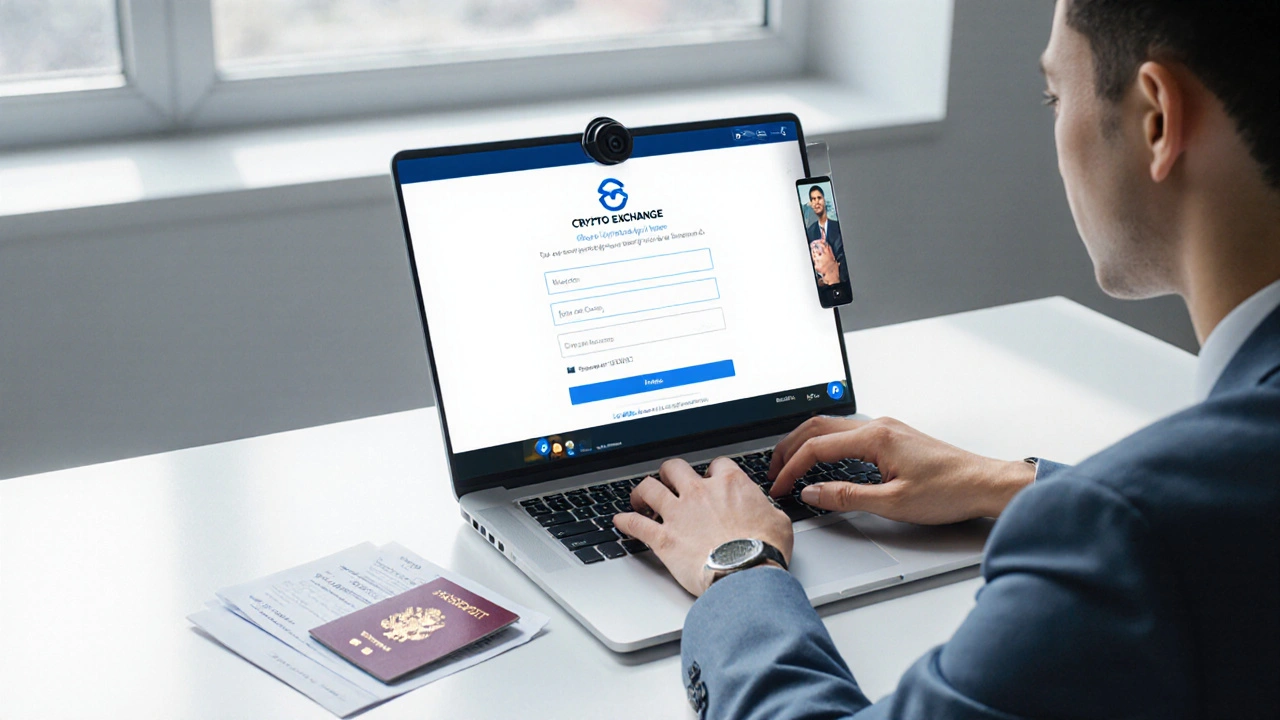

At the heart of any compliance program is the blockchain, a distributed ledger that records transactions without a central authority. The cryptocurrency, digital money built on top of blockchain technology runs on that ledger, but without rules it can be a free‑for‑all. That’s where KYC, Know‑Your‑Customer processes that verify user identities steps in. KYC, together with AML (Anti‑Money‑Laundering) checks, creates a chain of accountability: the blockchain records the transaction, the cryptocurrency is the asset, and KYC/AML make sure the people behind it are legit. This trio forms a semantic triple: **blockchain compliance** requires **KYC**, and **KYC** supports **regulatory compliance**.

Regulatory bodies like the SEC, FinCEN, and the EU’s AML directives shape what compliance looks like in practice. Their guidelines influence how smart contracts are written, because a contract that automates token distribution must also embed reporting hooks for auditors. In other words, blockchain compliance influences smart contract design, the coding of self‑executing agreements on a blockchain. When a contract can’t produce the data regulators need, it’s flagged as non‑compliant. This creates another semantic triple: smart contract design requires compliance‑ready data structures, and compliance drives contract architecture.

Beyond the technical side, compliance touches business decisions. A token launch that ignores KYC may enjoy a quick start but faces exchange bans, legal fines, or reputational damage. Conversely, a project that builds KYC/AML into its onboarding flow can list on more exchanges, attract institutional investors, and avoid costly retrofits. The relationship is clear: effective compliance enables market access, while poor compliance restricts growth. This dynamic is reflected across the articles below, from deep dives into Bitcoin’s halving impact on market dynamics to explanations of Layer 2 scaling and its regulatory implications.

Below you’ll find a curated set of guides that break down each piece of the puzzle. Whether you’re a developer looking to embed KYC checks, an investor gauging how regulations affect token value, or just curious about how the law meets the ledger, the collection gives you practical takeaways you can apply right away. Dive in and see how the pieces fit together in the real world of blockchain compliance.

4 Oct

4 Oct

Understanding KYC on Crypto Exchanges

Learn what KYC means for crypto exchanges, why it's required, how the verification works, regional differences, pitfalls, and future trends.

Read More...