Quick Summary

- KYC is the verification process crypto platforms use to confirm a user’s identity.

- Regulators worldwide require KYC to combat money laundering and fraud.

- The typical flow: sign‑up, document upload, verification, and account activation.

- Requirements differ across the US, EU, Singapore, and other jurisdictions.

- Best practice: keep documents secure, use reputable exchanges, and stay aware of evolving regulations.

If you’ve ever tried to buy Bitcoin on a mainstream platform, you’ve probably seen a form asking for your name, ID, and a selfie. That step is called KYC. In the crypto world, KYC acts as the bridge between the pseudonymous nature of blockchain and the real‑world need for compliance.

KYC is a set of procedures that financial services use to verify the identity of their customers and assess potential risks. The acronym stands for "Know Your Customer" and originated in traditional banking before being adopted by digital asset platforms.

Crypto exchange is a online marketplace where users can trade cryptocurrencies for fiat money or other digital assets. Exchanges range from centralized services like Binance and Coinbase to decentralized protocols such as Uniswap.

Why KYC Matters in Crypto

Regulators view crypto as a potential conduit for illicit finance. By requiring KYC, exchanges help authorities trace the flow of funds, enforce anti‑money‑laundering (AML) rules, and protect users from scams.

AML stands for Anti‑Money Laundering, a set of laws and procedures designed to prevent the financing of illegal activities. Most jurisdictions link KYC directly to AML compliance, meaning a failed identity check can trigger a report to financial intelligence units.

Beyond legal pressure, KYC builds trust. When an exchange knows who its users are, it can offer higher withdrawal limits, lower fees, and insurance against hacking incidents.

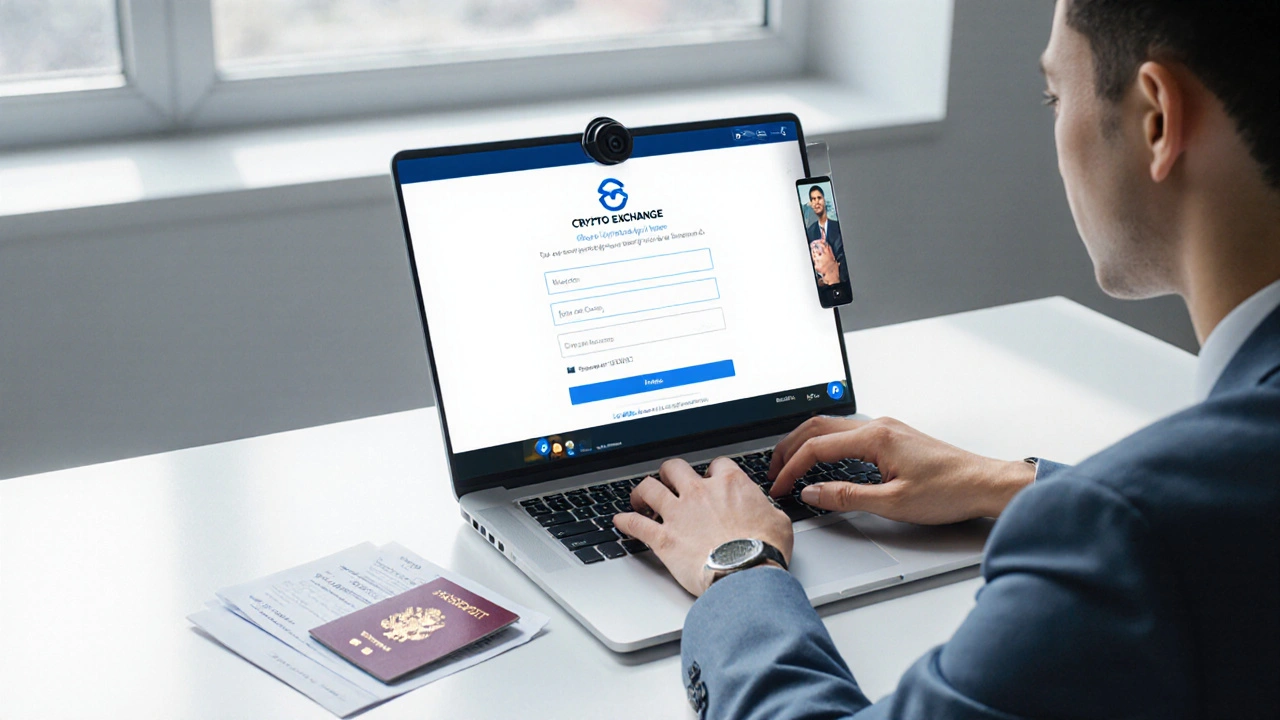

Step‑by‑Step: How KYC Works on an Exchange

- Account creation: The user provides an email, password, and sometimes a phone number.

- Document upload: A government‑issued ID (passport, driver’s licence, or national ID) is scanned. Some platforms also request a proof‑of‑address document like a utility bill.

- Live selfie or video: To confirm the person in the photo matches the ID, a short video or real‑time selfie is required.

- Data verification: Automated systems check the document’s authenticity, compare facial features, and cross‑reference against watchlists.

- Risk assessment: The exchange assigns a risk score based on factors such as transaction volume, jurisdiction, and source of funds.

- Account activation: Once approved, the user can trade, withdraw, and access premium features. If rejected, the user receives a reason and may appeal.

During verification, the exchange stores the data in encrypted databases and may share it with third‑party compliance providers. It’s crucial that the platform follows data‑protection standards like GDPR or local privacy laws.

Key Players in the KYC Ecosystem

Regulatory authority is a government or intergovernmental body that sets rules for financial services and enforces compliance. Examples include the U.S. Financial Crimes Enforcement Network (FinCEN), the EU’s Fifth AML Directive, and Singapore’s Monetary Authority (MAS).

Identity verification provider is a third‑party service that validates ID documents and performs facial‑recognition checks. Companies such as Jumio, Onfido, and Veriff are widely used.

Customer refers to the individual or entity that wants to trade digital assets on the platform. The customer’s data is the core of the KYC process.

Regional Variations in KYC Requirements

| Region | Document Types | Verification Method | Typical Withdrawal Limits (USD) | Notable Regulator |

|---|---|---|---|---|

| United States | Passport, Driver’s licence, State ID | Document + selfie + AML watchlist check | Up to $100,000 per day for verified users | FinCEN |

| European Union | d>Passport, National ID, Residence permitDocument + video liveness check | Up to €150,000 per day | European Banking Authority (EBA) | |

| Singapore | NRIC, Passport, Foreign Identification Number | Document + biometric facial match | S$200,000 per day | Monetary Authority of Singapore (MAS) |

| Australia | Passport, Driver’s licence, Medicare card | Document + selfie + address verification | AUD 250,000 per day | Australian Transaction Reports and Analysis Centre (AUSTRAC) |

These differences affect how quickly you can start trading and how much you can move. Some exchanges adopt the strictest standard globally to avoid maintaining multiple pipelines.

Common Pitfalls and How to Avoid Them

- Using low‑resolution scans: Blurry images often fail automated checks. Capture a clear photo in good lighting.

- Mismatched names: The name on your ID must match the account’s legal name. Minor spelling differences can trigger manual review.

- Out‑of‑date documents: Many jurisdictions reject IDs older than ten years. Keep passports and licences current.

- Sharing credentials: Never give your login details to a third‑party. KYC data is tied to a single verified account.

- Ignoring privacy policies: Check how the exchange stores and deletes your data. Look for GDPR‑compliant statements or similar clauses.

By following these tips, you reduce the chance of a frozen account and keep your personal information safe.

Future Trends: KYC Beyond the Exchange

Regulators are pushing for a unified “digital identity” that can be reused across services. Projects like the European Self‑Sovereign Identity (eSSI) and Australia’s Digital Identity Framework aim to let users control their data while providing verified credentials to any compliant platform.

Another trend is the rise of blockchain compliance tools that embed KYC hashes directly onto the ledger, enabling privacy‑preserving verification without exposing raw documents.

Finally, decentralized finance (DeFi) protocols are experimenting with “zero‑knowledge” proofs to prove user eligibility (e.g., age or AML clean‑status) without revealing identity, potentially reshaping the KYC landscape.

Frequently Asked Questions

Do I need KYC to trade on every crypto exchange?

Most reputable centralized exchanges require KYC for any account that can withdraw fiat or exceed a certain trading volume. Purely decentralized platforms often allow trading without KYC, but they lack fiat on‑ramps and may carry higher risk.

How long does the KYC verification process usually take?

Automated checks can approve an account within minutes. Manual reviews, especially for high‑risk jurisdictions, may take 1-3 business days.

Is my personal data safe on crypto exchanges?

Reputable exchanges encrypt data at rest and in transit, comply with GDPR or comparable privacy regimes, and limit access to essential staff. Still, you should treat KYC documents as sensitive and monitor your accounts for unusual activity.

Can I use a single KYC verification across multiple platforms?

Some services participate in “KYC‑as‑a‑Service” networks, allowing you to reuse a verification token. However, each exchange must verify that the token meets its local regulator’s standards.

What happens if my KYC is rejected?

The exchange will usually explain the reason (e.g., blurry document, mismatched name). You can correct the issue and resubmit, or you may need to choose a different platform that accepts alternative verification methods.