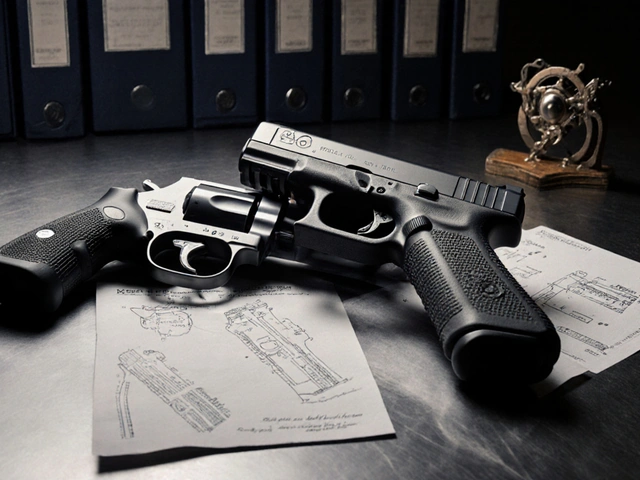

Were Guns Really Banned in Tombstone?

March 6 2025Mining Reward

When working with Mining Reward, the incentive paid to miners for adding a new block to a blockchain. Also known as block reward, it drives the entire proof‑of‑work ecosystem and fuels network security. Understanding this payout helps you see why miners invest in hardware, electricity, and time.

Key Concepts

The Proof of Work, a consensus mechanism that requires miners to solve computational puzzles is the engine behind every mining reward. When a miner finds a valid hash, the network grants the reward plus any transaction fees. This mining reward is typically fixed for a set number of blocks before a halving event reduces it, keeping supply in check.

Most miners join a Mining Pool, a group that combines hash power to find blocks more consistently. Pools split the reward based on contributed work, smoothing out the occasional big payouts into steady income. This arrangement lowers variance and makes it easier for small operators to stay profitable.

Another critical factor is Hash Rate, the total computational speed of a mining operation. Higher hash rates boost the chance of solving the puzzle first, which directly impacts how often a miner—or a pool—receives the reward. As more miners join, the network raises the difficulty, a process called Difficulty Adjustment, a regular recalibration that keeps block times stable.

Why do these pieces matter? A miner’s profit hinges on the balance between reward size, electricity costs, and hardware efficiency. When a halving cuts the reward in half, miners must either improve efficiency or accept lower margins. This dynamic pushes innovation in ASIC design and renewable energy use, shaping the whole crypto landscape.

If you’re just starting, focus on three steps: pick a coin with a clear reward schedule, calculate expected earnings using hash rate and power costs, and consider joining a reputable pool. Tools like online calculators can show you break‑even points and help you compare different algorithms.

Below you’ll find a curated collection of articles that dive deeper into each of these topics—covering everything from KYC on crypto exchanges to how layer‑2 scaling affects miner revenue, and even a look at historic firearm economics that surprisingly echo reward models. Read on to see how the pieces fit together and what the latest trends mean for your mining journey.

18 Sep

18 Sep

Bitcoin Halving Explained: What It Is and Why It Matters

A clear, 1500‑word guide explains Bitcoin halving, its schedule, impact on price, miners, and the crypto market, plus FAQs for beginners.

Read More...