Cowboy's Weapon of Choice: The Revolver that Dominated the Wild West

October 22 2025AML – What It Is and Why It Matters

When dealing with AML, anti‑money‑laundering measures that detect and stop illegal financial flows. Also known as Anti‑Money Laundering, it requires organizations to monitor transactions, verify customers and report suspicious activity. In plain terms, AML is the set of rules and tools that keep money from moving through hidden channels and ending up in criminal hands.

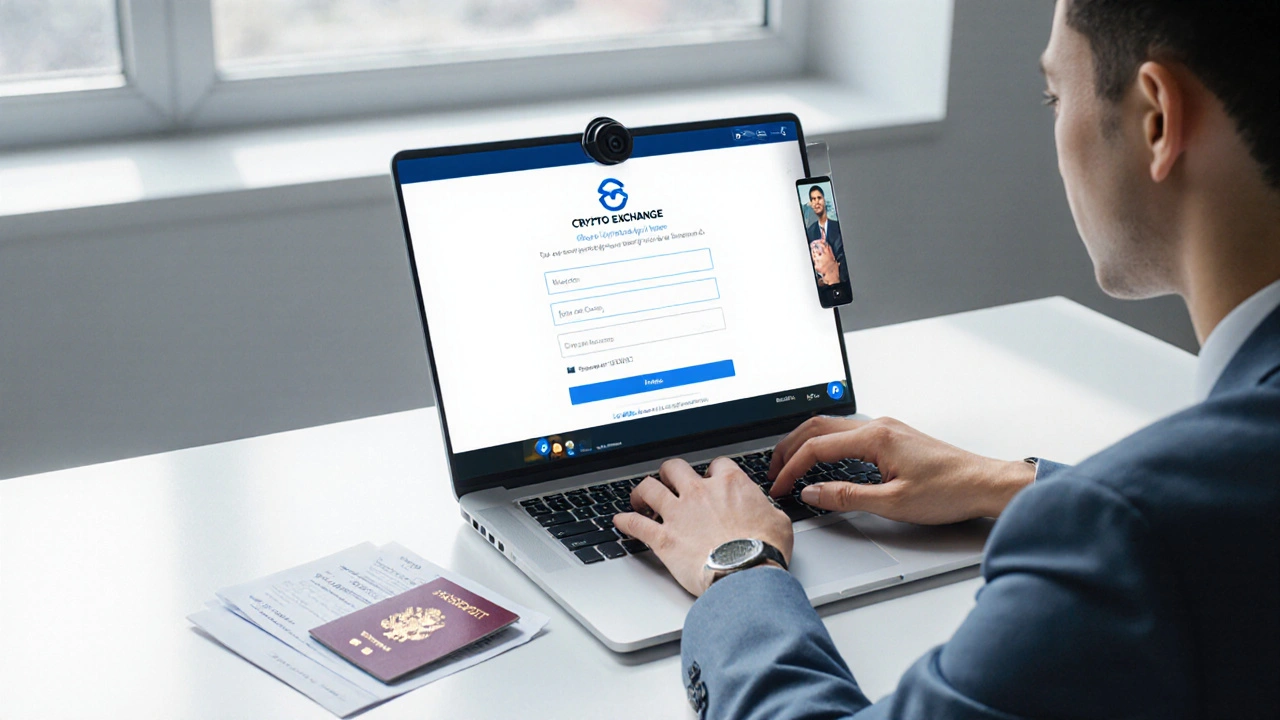

One of the biggest modern challenges for AML is cryptocurrency, digital assets that run on blockchain technology and can be transferred instantly across borders. Because crypto transactions are pseudonymous and settle quickly, they attract both innovators and bad actors. That’s why AML programs now include crypto‑risk assessments, blockchain analytics, and real‑time monitoring of wallet activity. The rise of Bitcoin halving events and Layer 2 scaling solutions, for example, changes the velocity of token flows, prompting regulators to tighten reporting thresholds.

Another arena where AML intersects with law is the firearms industry. Cases like the Glock vs. Smith & Wesson dispute highlight how weapon manufacturers must verify buyers, track shipments, and cooperate with authorities to prevent illicit sales. Financial compliance teams in these companies often run AML checks on dealers, ensuring that gun purchases aren’t used to fund illegal enterprises. This overlap shows that AML isn’t limited to banks—it’s a cross‑industry safeguard.

How AML Shapes Everyday Practices

Compliance officers rely on a few core attributes of AML: customer due diligence (CDD), transaction monitoring, and suspicious activity reporting (SAR). For a retailer selling vitamins or OTC stress‑relief products, CDD means confirming that bulk orders aren’t being funneled to money‑laundering schemes. In the health sector, pharmacists also run AML checks when handling high‑value supplements that could be used as a cover for illicit cash flow.

From a technical standpoint, AML requires robust data collection, pattern‑recognition algorithms and a clear audit trail. Modern tools apply machine‑learning models to flag anomalies, whether it’s a sudden spike in crypto withdrawals or an unusual pattern of firearm purchases. The synergy between AML and financial compliance, the broader framework that ensures organizations meet legal and regulatory standards creates a safety net that protects both consumers and the economy.

What you’ll see in the articles below is the breadth of AML’s influence. We break down Bitcoin halving mechanics, explore Layer 2 scaling and its compliance implications, dissect high‑profile gun lawsuits, and even dive into how pharmacists handle supplement sales while staying AML‑aware. Each piece offers a practical angle—whether you’re a crypto trader, a firearms dealer, a health‑store owner, or just curious about how money moves behind the scenes.

Ready to see how AML touches these diverse worlds? Scroll down for in‑depth guides, real‑world case studies, and actionable tips that will help you navigate the complex but essential landscape of anti‑money‑laundering compliance.

4 Oct

4 Oct

Understanding KYC on Crypto Exchanges

Learn what KYC means for crypto exchanges, why it's required, how the verification works, regional differences, pitfalls, and future trends.

Read More...