Cowboy's Weapon of Choice: The Revolver that Dominated the Wild West

October 22 2025KYC (Know Your Customer) – What It Is and Why It Matters

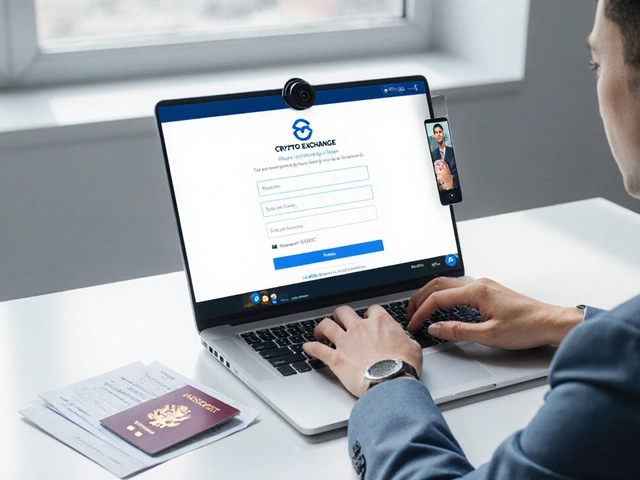

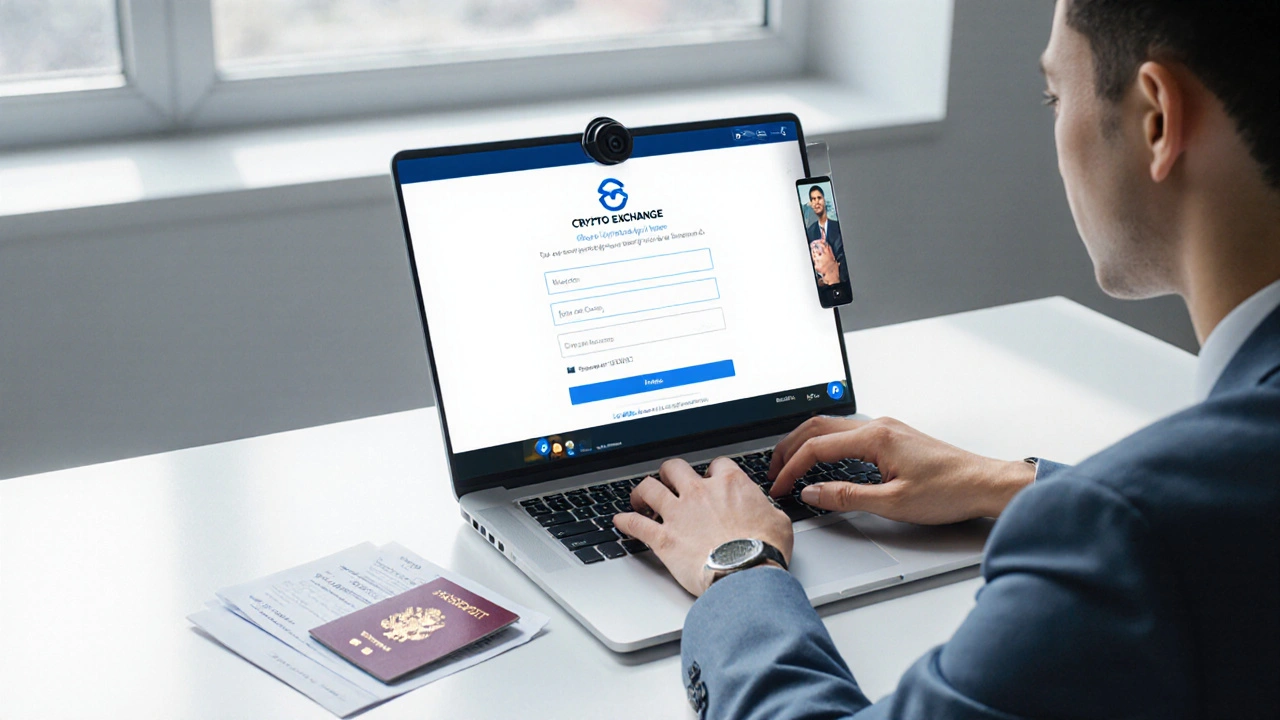

When working with KYC, a set of procedures used to confirm a client’s identity before allowing financial or digital transactions. Also known as Know Your Customer, it protects companies from fraud, money‑laundering and regulatory penalties. Cryptocurrency, digital assets that rely on blockchain technology and Compliance, the act of meeting legal and industry standards are two worlds that intersect heavily with KYC. Together they form a safety net that lets users trade, invest, or borrow without exposing the system to bad actors.

KYC isn’t just a checkbox for banks; it’s a full‑stack process that starts with collecting basic personal data – name, address, date of birth – and ends with ongoing monitoring of transaction patterns. In crypto, the process looks similar but adds wallet address checks, source‑of‑funds verification, and sometimes biometric scans. This layered approach mirrors the way a firearms dealer might verify a buyer’s eligibility under local law, showing that identity checks span many industries, from finance to shooting ranges. Whether you’re reading about the latest Bitcoin halving or a Glock vs. Smith & Wesson lawsuit, the underlying theme is the same: trusted participants keep the ecosystem stable.

Key Elements That Shape a Robust KYC Program

The first element is Identity Verification. Modern tools include government‑issued ID scans, facial recognition, and live video interviews. The second element is Risk Assessment, where algorithms score a user based on geography, transaction size, and known high‑risk indicators – a practice also used in AML (anti‑money‑laundering) compliance. Third, Ongoing Monitoring watches for unusual activity, just like a pharmacy tracks prescription refills to prevent abuse. Finally, Record Keeping ensures that every step is documented for auditors, much like how shooting clubs keep logs of range usage and safety briefings.

Because KYC ties directly into AML, many regulators treat them as two sides of the same coin. AML rules demand that businesses report suspicious transactions, while KYC provides the data needed to spot those red flags. In the fintech world, platforms that skip KYC often face fines, legal action, or loss of user trust. The same principle applies to other sectors covered in our posts – from detox supplements to cowboy‑action shooting – where transparency and verification build credibility.

Below you’ll find a curated set of articles that dive deeper into each of these topics. Whether you’re a beginner trying to grasp the basics of Bitcoin halving, a shooter curious about gun legality, or a health enthusiast looking at supplement safety, the collection shows how KYC‑style verification shows up in many corners of everyday life. Explore the guides, compare real‑world examples, and walk away with a clear picture of why solid identity checks are essential for any modern service.

4 Oct

4 Oct

Understanding KYC on Crypto Exchanges

Learn what KYC means for crypto exchanges, why it's required, how the verification works, regional differences, pitfalls, and future trends.

Read More...